-

Hotline : +84 981 282 028

- vyan.company@gmail.com

Raw Titanium Ore

Price:

ContactPeople are viewing this right now

1. PRODUCT DESCRIPTION

Titanium ore is a strategic raw material for modern industries, primarily containing two minerals: Ilmenite (FeTiO₃) and Rutile (TiO₂). Mined from coastal placers and primary deposits, Vietnamese titanium ore has large reserves but mostly exists in low-grade forms (0.6–0.7% heavy minerals). It plays a pivotal role in producing TiO₂ pigment (90% of global applications), titanium alloys, refractory materials, and high-tech industries (electronics, aerospace).

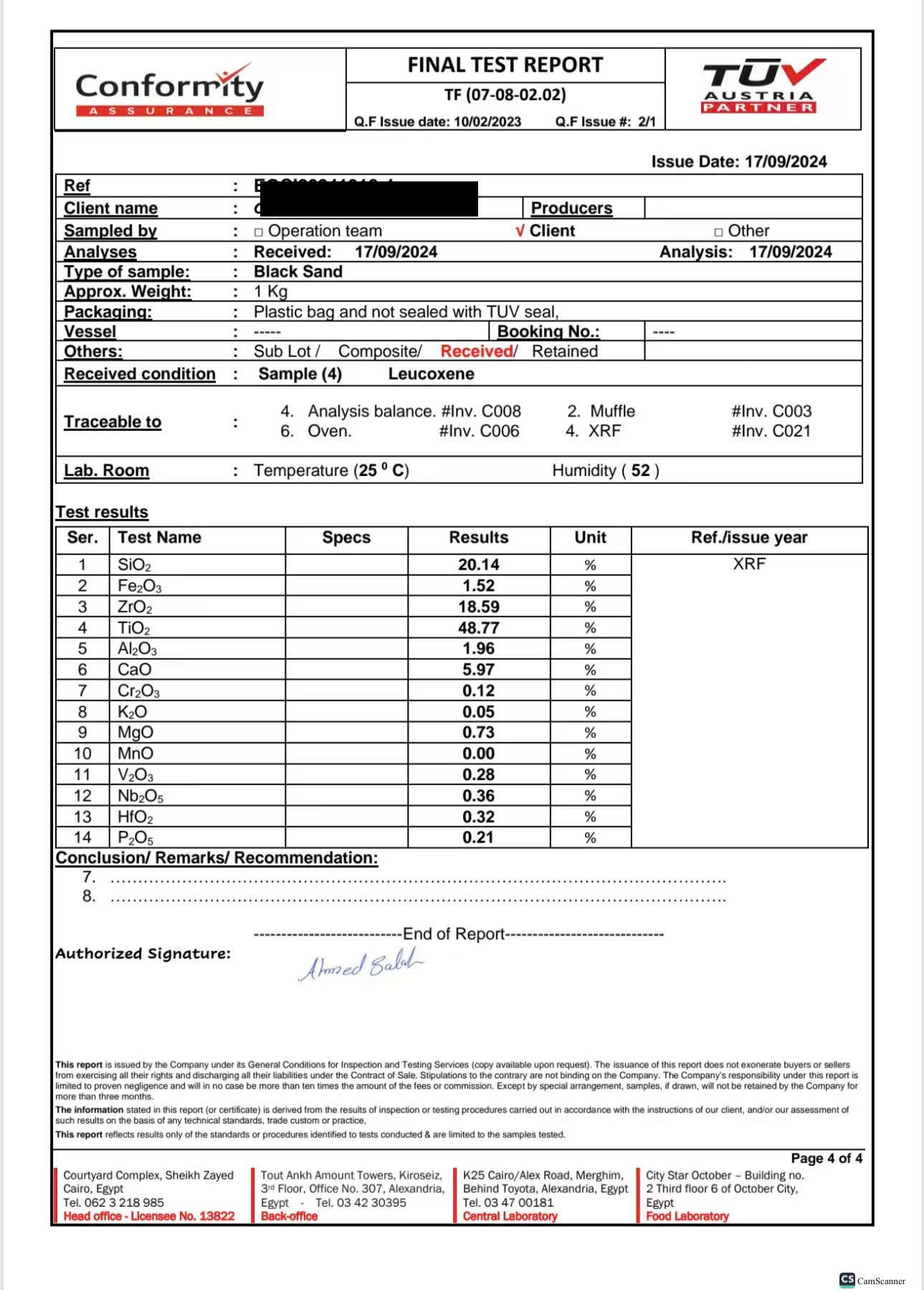

2. TECHNICAL SPECIFICATIONS

A. TECHNICAL PARAMETERS

TiO₂ Content:

- Ilmenite: 40–60%

- Rutile: 90–95%

Associated Minerals:

- Zircon (ZrSiO₄): 2–5%

- Monazite (rare-earth elements: Ce, La, Nd): 0.5–1%

Particle Size:

- Placers: 0.1–2 mm

- Primary ore: 5–50 mm

Melting Point:

- Ilmenite: 1,370°C

- Rutile: 1,843°C

B. MINING & PROCESSING STATUS

Mining Methods:

Placers: Gravity separation + magnetic sorting.

Primary ore: Underground/open-pit mining, with crushing + flotation.

Downstream Processing:

Ultra-fine Zircon Plants: 8 facilities in Hà Tĩnh & Bình Thuận (~45,000 tons/year, export-grade, particle size <5 µm).

Titanium Slag Smelters: 5 facilities (80,000 tons/year capacity, producing 70–75% TiO₂ slag).

Ilmenite Reduction: 2 plants (~10,000 tons/year) for welding rods/alloys.

C. DEVELOPMENT ROADMAP (2023–2030)

Short-Term:

Boost ultra-fine zircon output (>62% ZrO₂) to replace imports (~8,500 tons/year).

Expand titanium slag markets to EU/ASEAN, reducing reliance on China.

Mid-Term:

Build a TiO₂ pigment plant (30,000 tons/year, sulfate process).

Extract rare earths from monazite (target: 50–100 tons/year).

Long-Term:

Develop chloride process for porous titanium (post-2030).

Invest in titanium metal for aerospace/medical sectors.

D. CHALLENGES

Technical:

Low ore grades, high processing costs ($30–40/ton).

Power shortages for porous titanium production (25,000–40,000 kWh/ton).

Environmental:

Sulfuric acid/heavy metal waste from processing.

Need for red mud treatment and wastewater recycling tech.

1. RESOURCE STATUS

Vietnam possesses substantial titanium ore reserves, but most deposits are low-grade, averaging 0.6–0.7% heavy minerals (including remaining resources in gray/yellow sand layers).

Red sand layer deposits face challenges:

Water shortages for mining/processing.

High clay content → limits mining scale/efficiency.

Elevated production costs.

2. STRATEGIC PRIORITIES

Short-to-Medium Term Goals (2023–2030):

Develop mid-stream processing at scales aligned with mining capacity to dominate global markets for:

Titanium slag (70–75% TiO₂).

Synthetic rutile (key feedstock for pigments).

Reduce import dependence by gradually substituting domestically produced TiO₂ pigment.

Balance extraction-processing capacity to sustain current output levels.

Technology & Sustainability:

Ban new investments in outdated, polluting titanium slag technologies.

Upgrade existing facilities to:

Improve product quality (for export diversification beyond China).

Minimize environmental impact (e.g., acid/heavy metal waste).

3. PRODUCT-SPECIFIC STRATEGIES

Natural Rutile:

Reserve for high-end welding rods (import substitution) and future porous titanium/pigment production.

Zircon Byproducts:

Process low-grade zircon (57–64% ZrO₂) → upgrade to >62% ZrO₂ for:

Ultra-fine zircon (meeting Zircosil standards).

Zirconium oxide (higher-value export).

Opportunity: Global zircon shortage + Vietnam’s current ultra-fine zircon imports (~8,500 tons/year).

Porous Titanium/Metal:

Defer large-scale investments due to:

Prohibitive energy use (25,000–40,000 kWh/ton).

Lack of domestic chloride process expertise.

TiO₂ Pigment:

Immediate focus: Sulfate-process pigment plants (≥30,000 tons/year, EU-advanced tech with enhanced environmental controls).

Meet domestic demand + target regional exports.

Long-term goal: Pursue chloride-process plants (post-2030, post-feasibility studies on red sand deposits).

Rare Earth Recovery:

Extract rare-earth oxides (REOs) from monazite concentrates (Ce, La, Nd) → high-value byproduct.

4. CHALLENGES & RISKS

Technical:

Low ore grades → high beneficiation costs ($30–40/ton).

Energy-intensive processes vs. Vietnam’s power shortages.

Environmental:

Red mud/wastewater treatment requirements.

5. ACTIONABLE RECOMMENDATIONS

Prioritize R&D for:

Zircon refinement to >62% ZrO₂.

Rare-earth extraction from monazite.

Attract FDI for chloride-process pigment plants (post-techno-economic validation).

Enforce environmental standards in slag production to access EU/ASEAN markets.